4 in 5 Americans Who Need Insulin Have Taken on Credit Card Debt to Cover Cost

[ comments ]

The average amount of debt is $9,000.

A portion of monthly subscriptions goes to groups supporting our unhoused friends and neighbors. Please consider subscribing.

A damning new study from CharityRx revealed just how crushing the financial burden is for people who use insulin to manage their diabetes. For people who have needed insulin for years, the results won’t come as a surprise but it does illustrate what a widespread problem insulin price-gouging has become.

79% of diabetics in the United States who rely on insulin said price increases have created financial difficulties. 4 in 5 people report taking on credit card debt to cover the cost, with an average debt of $9,000.

Of the group who said they’ve taken on debt, 83% had to worry about covering other expenses to afford their medication. 63% have felt the need to sell prized possessions to pay for insulin while half feared cutting back on food. 62% reported rationing or skipping doses—an extremely dangerous cost-cutting measure. 29% have even had insulin prices impact their ability to pay their rent or mortgage.

Katharine is one of them. She’s a self-employed editor in her early 60s with type 2 diabetes. Both of Katharine’s parents had diabetes. Her father had type 1 and her mother, type 2.

“During my pregnancies carrying each of our sons, I had gestational diabetes and had to take insulin,” she told me. “After our second son was born, I had full-fledged type 2 diabetes at age 42.” This requires Katharine to take long-acting insulin every night before bed in addition to three doses of short-acting insulin at mealtimes.

Her husband is a master cabinetmaker who works for a small company doing custom jobs. Due to the company’s size, it isn’t required to offer health insurance. Katharine’s family can’t afford health insurance through the Affordable Care Act marketplace in New York. So, she pays out of pocket for her medication. Her long-acting insulin, Basaglar, costs $250.91 for 5 pre-filled pens. Her short-acting insulin, Lispro, costs $70.22 for 1 vial, which lasts her about 30 days.

“From our occupations, you can figure out that we’re not making huge salaries,” Katharine said. “I have put off follow-up checkups by my physician because I have to choose between paying for the insulin or paying for an office visit out of pocket. We have pushed back a mortgage payment now and then because we have to buy my insulin and groceries too.”

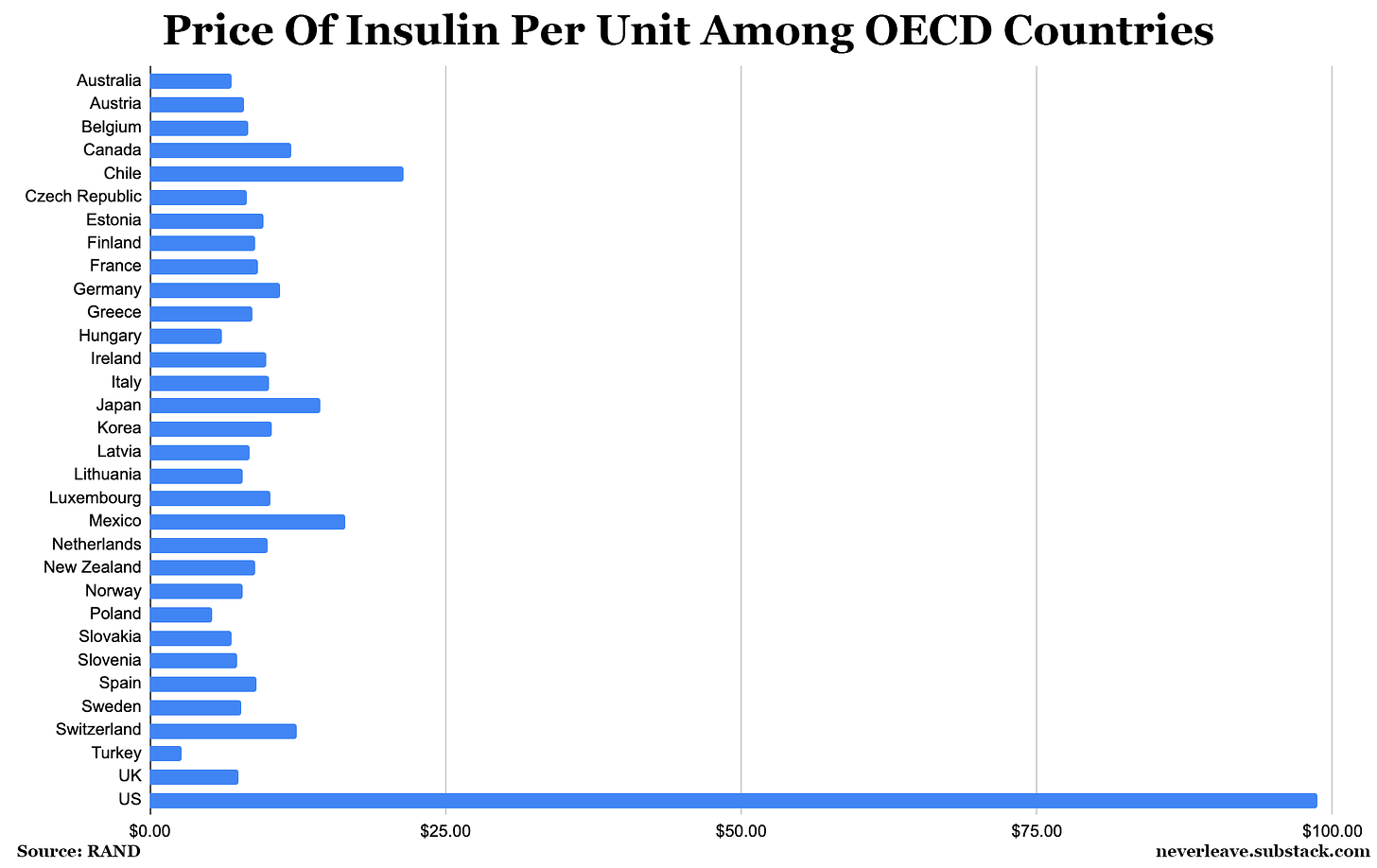

Katharine is among the growing number of Americans who struggle to afford their insulin due to corporate profiteering. The CharityRX study found that “when comparing the U.S. to countries around the world, the cost of insulin in the U.S. is 8 times higher than the combined average of other high-income nations.” Among OECD countries, the United States is a total outlier.

When researchers first developed insulin, they sold the patent for $1 to the University of Toronto. But due to a noxious mix of patents and regulatory hurdles, only three companies—Eli Lilly, Sanofi and Novo Nordisk—manufacture and sell insulin in the United States. A lack of transparency in the pricing process has led to prices tripling over the last 15 years. You can read a great breakdown of how we’ve reached this point in the American Prospect.

The insulin affordability crisis is so bad in the United States that it recently prompted a report from Human Rights Watch.

“Soaring medicine prices and inadequate health insurance coverage can result in unaffordable out-of-pocket costs that undermine the right to health, drive people into financial distress and debt, and disproportionately impact people who are socially and economically marginalized, reinforcing existing forms of structural discrimination,” the report states.

Diabetes ranks seventh in leading causes of the death in the United States. Going without insulin—or even rationing to cut costs—can lead to death. Diabetics who rely on insulin can’t just choose to not take insulin, so the corporate price-gouging of people who have no other options is what prompted Laura, 40, to become a patient advocate. She was diagnosed with type 1 diabetes 26 years ago and has watched the price Humalog rise from $21 to $300, an over 1,300% increase.

“To afford the insulin I need to survive, even as an attorney, I’ve given up seemingly everything. In 2012 when the owner of my law firm unexpectedly passed away, I suddenly lost my job and became uninsured to boot,” she said. “From 2012 until late-2014, to afford my insulin, I sold all my possessions, including my car, cashed out my retirement account, and accrued debt on multiple credit cards. I was forced to give up my dog for adoption because I could no longer afford to keep us both alive and healthy. And I am one of the lucky ones because I am still alive.”

The corporate greed fueling insulin price spikes has led to devastating consequences among Laura’s friends and in her social circles.

“I know young diabetics in end-stage renal failure from rationing insulin. Friends of mine have had limbs amputated because they couldn’t afford it. And countless diabetics have died of diabetic ketoacidosis because they didn’t have thousands of dollars to pay for the insulin they needed to survive,” she said.

On Wednesday, Senators Jeanne Shaheen (D-NH) and Susan Collins (R-ME), co-chairs of the Senate Diabetes Caucus, introduced the Improving Needed Safeguards for Users of Lifesaving Insulin Now (INSULIN) Act which aims to cap out-of-pocket co-payment costs for insulin at $35 a month. The bill, which would forward the progress made by the House earlier this year, was quickly championed by Senate Majority Leader Chuck Schumer, who promised a floor vote “very soon.”

Chuck Schumer @SenSchumer

Chuck Schumer @SenSchumer

June 22nd 2022

229 Retweets LikesBut as people were quick to point out in his, this doesn’t help people without health insurance. An estimated 31.6 million Americans don’t have health insurance, according to the Centers for Disease Control and Prevention. Laura agrees it doesn’t go far enough, especially because 9 out of the 10 diabetics who died from insulin rationing between 2017 and 2019 were uninsured.

“In order to qualify, I must have health insurance or Medicare and use whichever insulin my health insurer—not my doctor—dictates. By focusing solely on insulin copays for the insured, the Democrats’ plan does nothing to address the ever-increasing price of insulin,” Laura said. “If I am uninsured, if I can’t afford insurance, or if I lose my job and my employer-provided insurance, I must pay $300+ per vial for insulin I will die without. Proposed solutions that leave out the most vulnerable, those paying the most for insulin, aren’t solutions at all.”

Zoe, an organizer with Mutual Aid Diabetes (a network of diabetics who offer peer support and direct aid to other diabetics), agrees a co-pay cap that defers to insurance companies on brand selection is not the answer.

“What happens to diabetics with allergies, when the wrong brand is their insurance plan's $35 option? What happens if your insurance wants a prior authorization before they'll cover it at $35, but you have to buy it for the full list price today because you're almost out? What happens when you need 3 vials but they'll only cover 2 for $35? What happens when you're unhoused and don't have an address to receive mail at so you can't obtain insurance? But you can't get a job or a home until you have insulin? And you can't store your insulin in a fridge until you have a home? And you can't get a new prescription for insulin until you have insurance?” Zoe said.

These glaring flaws in the bill leaves people like Madison hanging in the balance. The 24-year-old barista with type 1 diabetes is thankful she’s still on her parents insurance but is uncertain about her future. With her 25th birthday in October, she’s just over one year away from no longer being eligible to remain on her current insurance plan.

“Once I don’t have that insurance in a year, the job I have doesn’t offer benefits so I will have to pay $325 for the drug that keeps me alive and is only [around] $3 to produce,” she said. And despite currently being insured, she’s still been deeply impacted by costs associated with other supplies.

Her insulin pump products cost $50 every month, glucose monitor supplies are $180 every 2 months and she needs to spend an additional $100 or so every few months on supplemental supplies. When those bills fall around the same time, as they sometimes do, it becomes extremely difficult to afford.

“I have to sell clothes, ration grocery shopping and gas in order to come up with the amounts of money I need,” she told me. “I’ll go weeks without supplies and just stress everyday about it.”

Groups like Mutual Aid Diabetes help people make ends meet but they acknowledge it’s just a temporary solution to a permanent problem.

“Because we need both a prescription for insulin (often also a prior authorization) and a way to pay for it, even people who have financial means can find themselves without insulin. 50% of the requests MAD gets for help obtaining insulin are from uninsured diabetics,” Zoe said. “Many doctors won't write a prescription for an insulin-dependent unless they come to an appointment—something the uninsured absolutely can't afford. And of course in the US since our insurance is primarily employer based, if we lose our jobs unexpectedly we find ourselves uninsured.”

A recent survey by Data For Progress found that a vast majority of voters across party lines overwhelmingly support price caps on insulin. 87% of democrats, 86% of republicans and 82% of independents support caps.

“The federal government must act to cap the price that insulin makers can charge to no more than $20 (the equivalent of what other countries pay),” Laura said. “Congress must introduce legislation that centers diabetic patients’ needs and take [big pharma’s] greed head-on, ensuring that every single US diabetic can afford and obtain the insulin we die without, regardless of financial status and regardless of whether we have health insurance.”

You can call your Representative and Senators and and tell them you want Congress to cap the price of insulin via the US Capitol switchboard at 202-224-3121.

Mutual Aid Diabetes is seeking volunteers, especially people who have experience obtaining diabetes medications and supplies, anyone who has experience connecting community members with services (food assistance, housing assistance, Medicaid, Medicare, insurance, etc.,) and anyone who has worked in trauma-informed care or with other mutual groups. You can email MutualAidDiabetes@gmail.com to get involved.

Thank you for reading. If you enjoyed this piece, please share it and . And if you’d like to subscribe to this Substack, can do so below. A portion of proceeds from monthly subscriptions goes to groups supporting our unhoused friends and neighbors.

Photo courtesy of 2C2K Photography/Creative Commons

Ready for more?

[ comments ]